As we age, our financial goals and responsibilities evolve, making it essential to reassess our life insurance needs. For those over 45, choosing the right life insurance policy is crucial to ensure financial security for loved ones, cover final expenses, and even build cash value for future needs. In this blog post, we’ll explore some of the best life insurance options for people over 45, with a particular focus on participating whole life insurance and final expense/burial insurance.

Understanding Your Life Insurance Needs After 45

Once you cross the 45-year mark, your life insurance needs might include:

- Income Replacement: If you still have dependents relying on your income, life insurance can provide financial support for them.

- Debt Coverage: Ensuring any outstanding debts, like a mortgage or loans, are paid off.

- Final Expenses: Covering costs related to funerals, medical bills, and other end-of-life expenses.

- Estate Planning: Facilitating wealth transfer to heirs and managing potential estate taxes.

- Cash Value Accumulation: Providing a financial cushion or supplementing retirement income through policies that build cash value.

Participating Whole Life Insurance: A Robust Option

Participating whole life insurance is a popular choice for those over 45, and for good reasons:

- Lifetime Coverage: Unlike term insurance, which expires after a set period, whole life insurance provides coverage for your entire life.

- Cash Value Growth: Part of your premium goes into a cash value account that grows over time. This can be borrowed against or even withdrawn, providing financial flexibility.

- Dividends: As a participating policyholder, you may receive dividends, which can be used to reduce premiums, increase the policy’s cash value, or be taken as cash.

- Stable Premiums: Premiums are generally fixed, making it easier to manage your budget over the long term.

Final Expense/Burial Insurance: Peace of Mind for You and Your Loved Ones

Final expense or burial insurance is specifically designed to cover end-of-life expenses. Here’s why it’s a suitable option:

- Affordable Premiums: These policies typically have lower face values (ranging from $5,000 to $25,000), resulting in more affordable premiums.

- Simplified Underwriting: Often, these policies do not require a medical exam, making them accessible to individuals with health issues.

- Quick Payout: The death benefit is paid out quickly, ensuring that your family can cover funeral costs and other immediate expenses without financial strain.

- Guaranteed Acceptance: Some final expense policies guarantee acceptance up to a certain age, ensuring coverage regardless of health conditions.

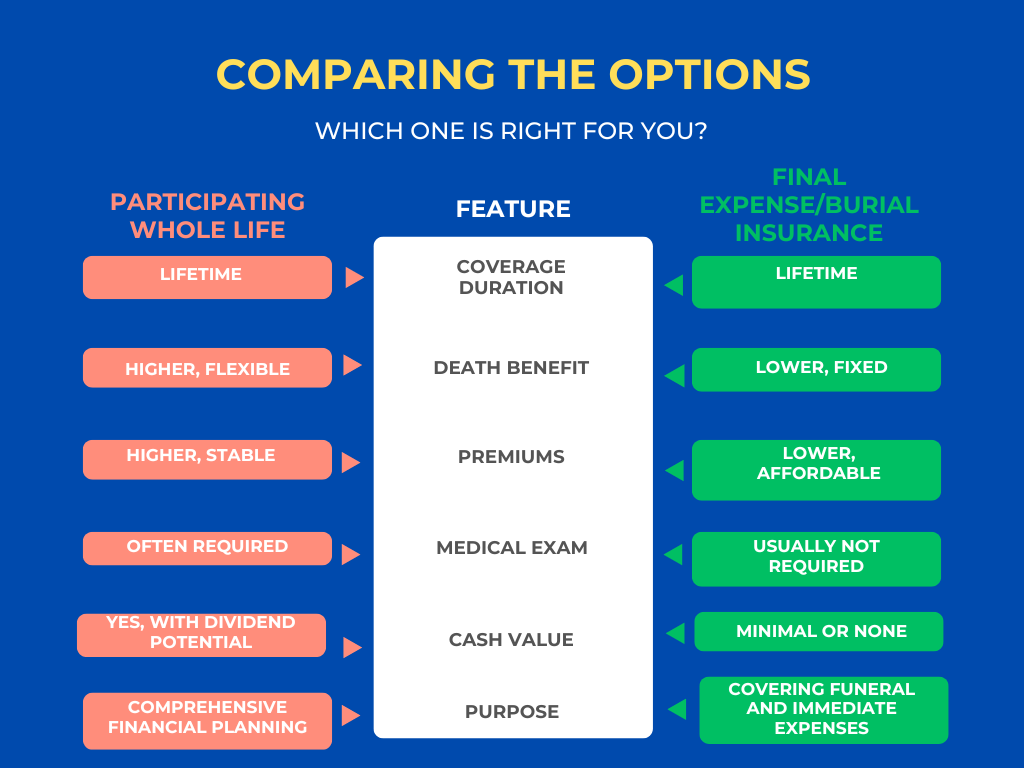

Comparing the Options: Which One is Right for You?

The decision between participating whole life insurance and final expense insurance depends on your specific needs and financial situation. Here’s a quick comparison to help you decide:

Conclusion

Choosing the right life insurance policy after 45 is a crucial step in securing your financial future and ensuring peace of mind for your loved ones. Participating whole life insurance offers a robust solution with lifelong coverage and the potential for cash value growth and dividends. On the other hand, final expense or burial insurance provides an affordable and straightforward way to cover end-of-life expenses without the need for extensive medical underwriting.

Assess your financial situation, consider your coverage needs, and consult with a financial advisor to make an informed decision that best suits your circumstances. With the right policy in place, you can confidently face the future knowing that you’ve taken steps to protect your loved ones and your legacy.

If you found this post helpful or have any questions, feel free to leave a comment below or reach out to our insurance experts for personalized advice.